What is the Best Interests Duty for mortgage brokers?

What is the Best Interests Duty for mortgage brokers?

The best interests duty for mortgage brokers is a statutory obligation for mortgage brokers to act in the best interests of consumers (best interests duty), and to prioritise consumers’ interest when providing credit assistance (conflict priority rule).

These two obligations are collectively referred to as the Best Interests Duty.

Based on the Royal Commission’s recommendations, it aims to align “consumers’ expectation and interest with that of the interest of the mortgage broker.”

When will the Best Interests Duty come into effect?

The Best Interests Duty for mortgage brokers officially came into effect on 1 January 2021.

Initially, the legislation passed both houses on February 2020 and was supposed to come into effect on 1 July 2020 but was delayed to January 2021 to allow the mortgage industry to focus on immediate priorities and the needs of their customers amid the COVID-19 crisis.

How are a consumer’s best interests assessed?

ASIC, the industry regulator who’s been tasked with its implementation, released its regulatory guide (RG 273) on assessing the best interests of the consumer by:

- The cost of a product—such as interest rate, fees and charges and repayment size—as factors that should generally be prioritised during this assessment; however, cost is not the only matter relevant to whether recommending a product is in the consumer’s best interests.

- Where other non-cost considerations affect what is in the consumer’s best interests, brokers should assess whether those considerations or loan features have a realistic possibility of offering the consumer, good value or a net benefit relative to other options.

What does the Best Interests Duty mean for customers?

Mortgage brokers now operate under an unrivalled Best Interests Duty when providing credit assistance to consumers, which provides yet another compelling reason to use a broker.

This new legal duty offers customers peace of mind knowing that their mortgage broker is legally required to act in their best interests and put their interests first.

Did you know that the Best Interests Duty doesn’t apply to banks?

As mortgage brokers, we act in your best interests when recommending a home loan, whereas a lender sells you their products. In other words, we must always act in your best interest; however, if a customer goes to a bank directly, then the bank can act in their own interests and not those of the borrower.

Looking for a home loan recommendation but don’t know whom to trust? Mortgage brokers put your best interests first.

ASIC’s BID guidance

Whilst price (interest rates and fees) will always be a determining factor, in some cases, the cheapest price may not be the best outcome.

Especially if the loan cannot be approved with the cheapest lender or the service proposition of the cheapest lender means missing out on the property the client wants to purchase.

ASIC’s final BID guidance outlines, “Some consumers’ circumstances will mean that the benefits provided by particular features might outweigh the importance of cost,” acknowledging the fact that some consumers will prioritise approval time and compromise on cost because of a time-sensitive transaction, such as impending settlement dates, or may value access to an offset account or the service levels and policies of the credit provider.

Therefore, mortgage brokers are expected to “exercise judgment in considering the relevance of these factors with reference to the consumer’s individual circumstances”.

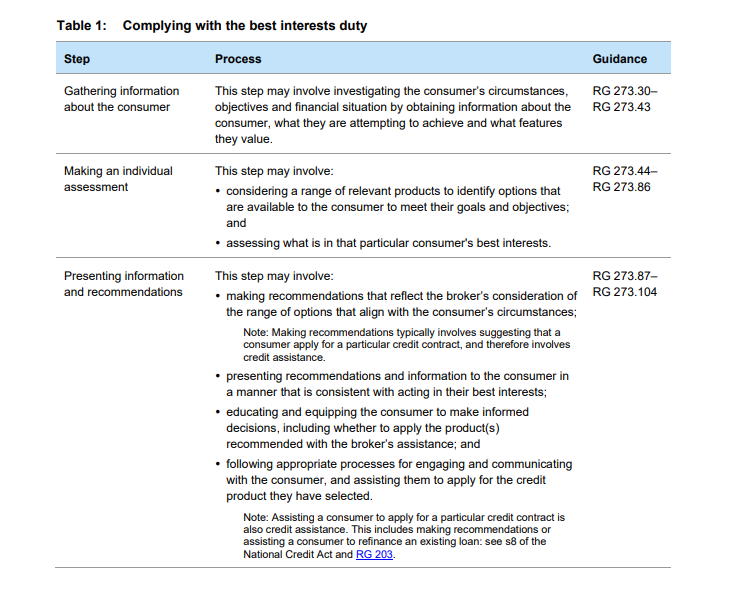

The guidance highlights how mortgage brokers may comply with the best interests obligations at key stages of the credit assistance process, and provides numerous examples.

Requests made by customers, not in their best interest

In cases where “Consumers may also have a strong preference for a loan feature that may not be in their best interests. For example, consumers may insist on an interest-only loan or offset account when it is not, in your view, in their best interests.”

The broker is expected to make “reasonable efforts to explain to the consumer why these features may not be appropriate or may not offer good value to them” so as to help them make an informed decision.

However, the guidance goes on to state that “If the consumer decides to still proceed with an application for that product, you may assist the consumer with that application.”

Another example is when “consumers may have strongly held beliefs or preferences about certain credit providers and will not consider those providers, regardless of the competitiveness of their product offering.”

The guidance states that in these situations, “you (brokers) may still reasonably consider and recommend products from these credit providers, rather than exclude them from the outset.”

What is the conflict priority rule?

The conflict priority rule is an additional requirement in the new best interests obligation, which requires mortgage brokers to resolve conflicts of interests in the consumer’s favour.

According to the draft guidance, “The conflict priority rule means that you must not recommend a product or service of a related party that would create extra revenue for yourself, your credit licensee or another related party, unless doing so would also be in the consumer’s best interests”.

More importantly, if there’s a conflict of interest, and the broker is unable to prioritise the consumer’s interests, then the broker must not provide the credit assistance.

Scenario: Aligning interests

A customer approaches a mortgage broker for a home loan. Based on the information provided, the broker concludes that ‘Home Loan – Product A’ with an offset account and no annual fees is the best home loan for the customer. The second best is ‘Home Loan – Product B’, which is similar but has a $200 annual fee. ‘Home Loan Product A’ which the broker thinks is best for the customer also gives the broker a higher commission on the same loan amount.

In prioritising the consumer’s interests, it is possible that the interests of the consumer and the broker will align. In this situation, the fact that there is a benefit for the broker does not indicate that the broker did not prioritise the customers’ interests.

However, if the situation was reversed, and the credit provider charging the annual the fee (Product B) paid the broker a higher commission, recommending the higher fee product would be inconsistent with the conflict priority rule.

Does the Best Interests Duty apply to banks?

No, the Best Interests Duty doesn’t apply to banks!

Mortgage brokers have to follow the best interest duty; however, banks do not. In other words, we must always act in the best interests of borrowers; however, if a customer goes to a bank directly, then the bank can act in their own interests and not those of the borrower.

Mortgage brokers offer choice, experience and have a legal duty to act in your best interests when providing credit assistance. As mortgage brokers, we act in your best interests when making a credit recommendation, whereas a lender sells you their products.

We welcomed the implementation of the Best Interests Duty (BID) as our customers can rest easy knowing that when dealing with us, we’re acting in their best interest. This has differentiated us significantly from the banks.

Are mortgage brokers now under a Best Interests Duty?

Yes, mortgage brokers are officially under the Best Interests Duty obligations from 1 January 2021. Mortgage brokers now have a legal duty to put customer’s interests first when providing credit assistance.

At Cornerstone Home Loans, we were already working in the best interests of our customers; as such, we don’t anticipate major changes. We’ll keep focussing on doing the right thing for our customers, as we’re well placed to meet these obligations.

What is ASIC’s approach to best interests obligations?

Since ASIC’s guidance is typically how the industry models things, ASIC has outlined its approach to the best interests duty obligations as below. According to the guidance, it:

- is designed to more closely align the interests of the consumer and the mortgage broker.

- are high-level principles and do not have prescriptive steps that a mortgage broker can follow to ensure they can comply. It is the responsibility of mortgage brokers to ensure that their conduct meets the standard of ‘acting in the best interests of consumers’ in the relevant circumstances.

- is not intended to provide a ‘safe harbour’.

- cannot be avoided by any notice or disclaimer provided to or signed by a customer.

ASIC – Best Interests Duty guidelines

ASIC has released the draft guidance which centres around the common steps in the processes used by mortgage brokers, namely:

- Gathering information about the consumer. Mortgage brokers should gather relevant information to ensure they can provide recommendations that will be in the consumer’s best interests. The draft guidance indicates that this may involve an iterative process of receiving instructions and making inquiries.

- Assessing what is in the consumer’s best interests. Mortgage brokers should consider products holistically to assess whether they are in the consumer’s best interests. The factors and their relative importance will depend on the consumers’ situation. Factors to be considered are both cost-based such as interest rate, fees and charges, and non-cost considerations or loan features, i.e. redraw, offset etc.

- Presenting information and recommendations. Mortgage brokers should provide guidance to encourage mortgage brokers to, where necessary, tailor how they present product options and recommendations to account for the consumer’s expectations and circumstances. We also propose to emphasise the educative role of mortgage brokers and the importance of presenting a range of options.

What are the penalties for breaching the Best Interests Duty obligations?

There are civil penalties for breaching the obligations of the Best Interests Duty.

Any failures to meet the best interests or conflicted remuneration obligations will incur a maximum civil penalty of 5,000 penalty units, which equates to $1,050,000.

What are some issues with the Best Interests Duty?

ASIC’s guidance on Best Interests Duty is more high-level, principle-based than actual prescriptive steps for mortgage brokers.

Unlike the Best Interests Duty for financial advisers, wherein, financial advisers who’ve taken the safe harbour steps outlined, are considered to have met their obligation to act in the best interests of their client. There is no such provision for mortgage brokers.

While the guidance may help mortgage brokers to determine what they need to do to comply, they remain responsible for deciding how they will comply with the best interests duty and the conflict priority rule when providing credit assistance.

Are you looking for the best home loan based on your situation?

Here’s how we can recommend the best home loan based on your situation.

We’ll first conduct a Preliminary Credit Assessment wherein; we look at your financial situation; and your objectives and product requirements for seeking credit.

Finally, based on our discussions and the lenders you qualify with, we’ll make our recommendations that best match your needs and requirements. Please be aware that it is not always possible to recommend a product that satisfies all of your objectives; the product selected will be the closest match to your requirements.

As a mortgage broker, we act in your best interests when recommending a home loan, whereas a lender has no legal obligation to do so.