National Housing Values Lift by 16.1%

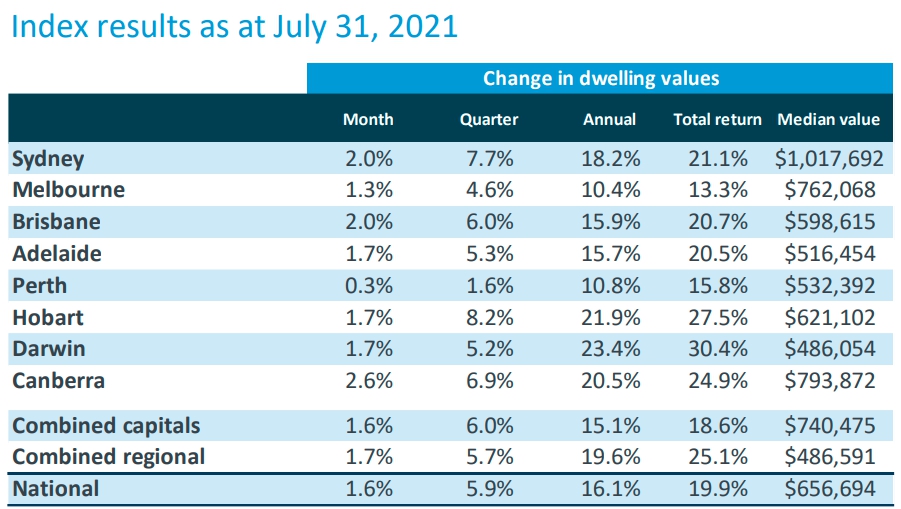

Housing values rose 1.6% in July 2021. This increase takes Australia’s housing values 16.1% higher over the past 12 months and 14.1% higher over the first seven months of calendar 2021.

CoreLogic research director Tim Lawless says, “The 16.1% lift in national housing values over the past year is the fastest pace of annual growth since February 2004; however, the monthly growth rate has been trending lower since March this year, when the national index rose 2.8%.”

What Is Causing The Lower Rate of Growth?

The pace of capital growth has been tapering since April 2021. The recent lockdown in Sydney has contributed to a loss of growth momentum.

- Housing values are rising more in a month than income, which is causing affordability constraints. With income stagnating, many people can’t save enough for a deposit to enter the market.

- The pace of property price appreciation for capital cities slowed down. The biggest fall was in Sydney, where capital gains fell from 3.7% in March 2021 to 2% in July 2021. As the most expensive capital city, Sydney was experiencing an increase in its property values over the first seven months. The recent lockdown is creating negative consumer sentiment.

- The strong performance of the regional markets over capital cities normalised through 2021. The first seven months show an almost equal growth of 14.5% and 14% for the combined regional market and combined capital markets, respectively.

- The supply cannot keep pace with demand. Active listings are 26% below the five-year average.

Although the rate of growth is easing, housing values are rising faster than average. Over the last 10 years, the average pace of monthly dwelling appreciated 0.4%.

What Happened To Australia’s Property Market In July 2021?

- Houses are performing stronger than units. Over the 12 months ending in July, national house values were up 18.4% compared with 8.7% for unit values. This trend is evident across all capital cities except Hobart, where unit values were up 23% compared with 21.7% for house values.

- There was a sharp decline in advertised properties due to the lockdowns in Sydney and Melbourne. In Sydney, listings fell by at least 30% and in Melbourne, they fell 27% between the weeks ending 11 July and 25 July.

- Auction clearance rates are at 70% across major markets. People are opting for private treaty sales due to the lockdowns.

- The most expensive quarter of the capital city market is leading the pace of growth, but it’s showing signs of a slowdown. Although the upper quartile experienced a 7.8% rise in values over the three months ending July 2021, it also had the sharpest slowdown. The quarterly pace of gains has fallen by 1.4 percentage points since its peak in April 2021.

- There is an estimated 42% lift in the number of home sales. In the last 12 months, 600,000 properties were sold, which is 140,500 more sales than the decade average. The annual number of home sales has not been this high since January 2004.

- The annual pace of growth for national rents increased to 7.7%, which is the fastest appreciation since 2008. Due to low vacancy rates and high rental demand, Darwin and Perth have the tightest rental markets. On the other hand, the rental markets in Sydney and Melbourne are stabilising with a reduction in rents. There was a high vacancy rate due to stalled migration and people moving away from high-density living due to the pandemic.

- The average gross rental yield is 3.4%, which is a record low. Sydney experienced the biggest drop, with a gross rental yield of 2.5%, while Melbourne is at 2.8%. The other capital cities all have gross rental yield above 4%. These cities are likely to provide property investors with positive cash flow investment opportunities.

There is competition in the market due to strong buyer demand and low active listings. Housing values were resilient during previous circuit-breaker lockdowns. Once restrictions are lifted, the pent-up demand could increase market activity.

Home sales and listings were disrupted during the recent lockdowns. And with the uncertainty surrounding Sydney’s lockdown, there could be reduced market activity.

Buy Now Or Wait?

Property buyers are embracing technologies like online auctions, virtual tours and online mortgage brokers to get approved for a home loan, even during a lockdown.

The best time to buy a house is what makes sense for your situation. If your job and income are stable and you’ve got a handle on your expenses, it might be better to buy now than wait.